Credit Scores & Credit Reports

Why do you care?

Credit Scores and Credit Reports are the primary source your lenders will use to determine your creditworthiness! Correcting any errors is key to provider lenders with your true worthiness, lowering your interest, increasing your buying power, increasing your disposable income, and more!

WARNINGS

FIRST A quick search on the internet can reveal a massive amount of advertising and options to obtain and maintain your credit report. At $30 a month, you are paying $360, so evaluating the benefits and costs. SECOND. Beware of companies scamming your information online for free or a low fee. They get your social security, birth date, email address, and credit card information - this is not good if they are criminals.

WHAT'S YOUR SCORE? Why do you care?

AKA "FICO score" or "Credit Rating." Basics: It is a three digit point system created and used to evaluate and analyze credit points. It compares your past and current spending, credit use, and payment along with other factors as compared with similar consumers. The credit scoring method was changed to the VantageScore in 2006.

Score Range: 300-850

Poor: below 650 Good: above 650 (Less of a Credit Risk)

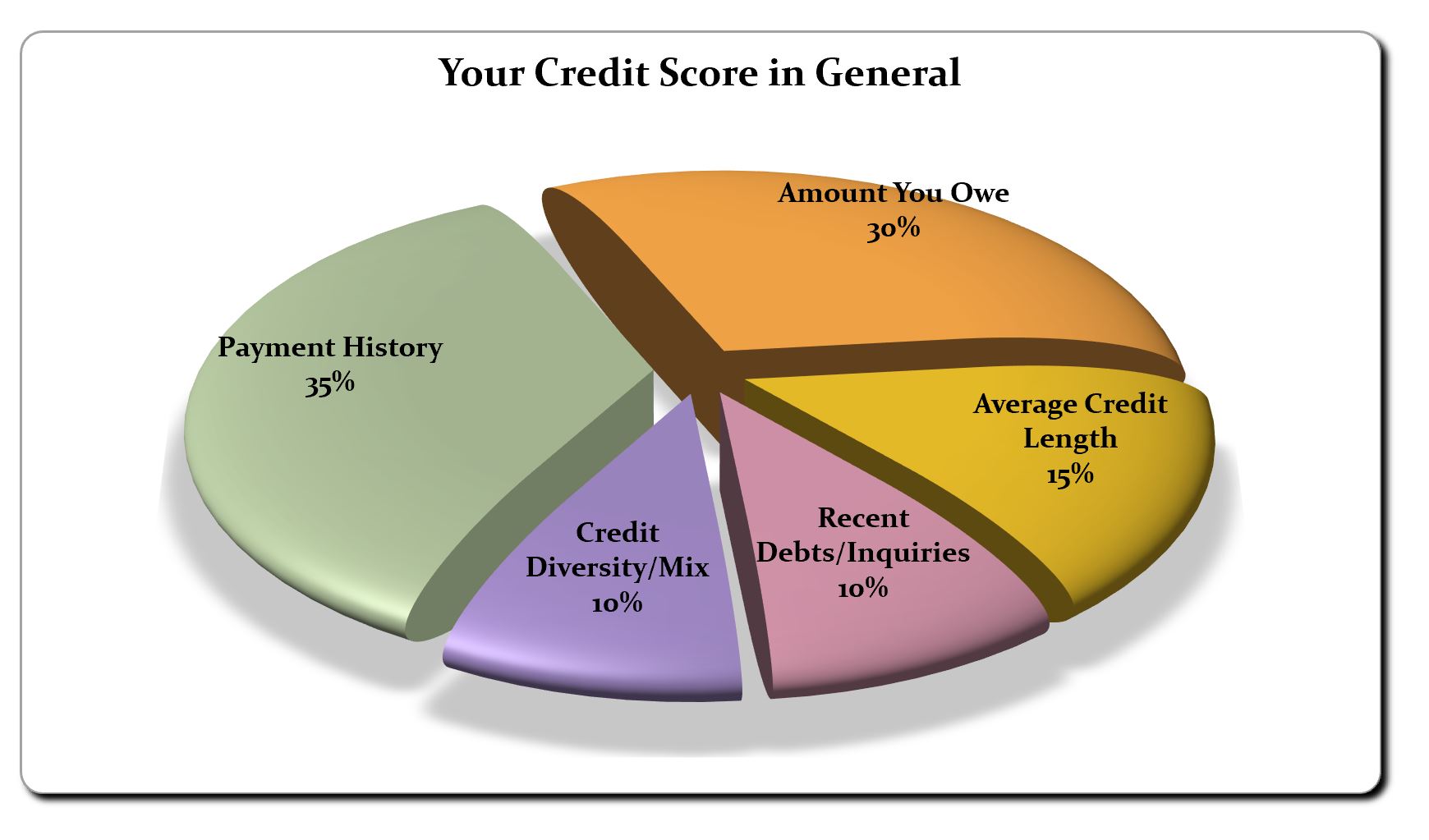

What Matters:

Types of Credits, Recent Credit, Balance on Credit, Balance on Credit in Comparison to Available Credit, Payment History, Length of Credit Lines & Average Credit Length, Number of Credit Lines, and more.

WHAT IS IT USED FOR? Creditors are able to quickly evaluate your behaviors based on this score. This method takes out factors that are irrelevant and provides a more objective process in credit lending, landlord evaluation, and insurance companies.

WHERE TO GET IT FREE?

At least when you are denied and once a year, you can obtain your credit report free.

Credit Report Free: www.annualcreditreport.com

After establishing your first overall report, you can obtain your reports at various points in the year to keep a check... Equifax in January 1, Experian in May 1, and Transunion Sept 1.

KEEPING THE SCORE STRONG OR IMPROVING YOUR CREDIT